Table of Content

This market is set to increase as more retirees require finance in retirement. Recent Financial Services Authority guidelines to UK lenders regarding interest-only mortgages has tightened the criteria on new lending on an interest-only basis. In addition to the two standard means of setting the cost of a mortgage loan , there are variations in how that cost is paid, and how the loan itself is repaid. There are also various mortgage repayment structures to suit different types of borrower.

Your lender may also ask you to provide more information or documents at this time. A study issued by the UN Economic Commission for Europe compared German, US, and Danish mortgage systems. The German Bausparkassen have reported nominal interest rates of approximately 6 per cent per annum in the last 40 years . German Bausparkassen are not identical with banks that give mortgages.

Eligibility

Over this period the principal component of the loan would be slowly paid down through amortization. In practice, many variants are possible and common worldwide and within each country. This law also introduced a refinance component to the VA loan program. Veterans who had purchased homes when interest rates were high could now take advantage of market changes. They could also extract cash from their equity and use the capital to pay off debt, make home improvements, send their kids to college and myriad other purposes.

In the United States until December 31, 2017, it was possible to deduct home equity loan interest on one's personal income taxes. As part of the 2018 Tax Reform bill signed into law, interest on home equity loans will no longer be deductible on income taxes in the United States. As you pay off your home loan, the amount you have paid becomes equity. You can use that equity as collateral to borrow more money if you need it to send a child to college, make home improvements, or pay off other debts.

Eligibility Today!

The basic intention of the VA home loan program is to supply home financing to eligible veterans and to help veterans purchase properties with no down payment. In April 2014, the Office of the Superintendent of Financial Institutions released guidelines for mortgage insurance providers aimed at tightening standards around underwriting and risk management. The most common mortgage in Canada is the five-year fixed-rate closed mortgage, as opposed to the U.S. where the most common type is the 30-year fixed-rate open mortgage. Since the crisis, however, the low interest rate environment that has arisen has contributed to a significant increase in mortgage debt in the country.

They have also proved beneficial to people who had an interest-only mortgage with no repayment vehicle and now need to settle the loan. These people can now effectively remortgage onto an interest-only lifetime mortgage to maintain continuity. Upon making a mortgage loan for the purchase of a property, lenders usually require that the borrower make a down payment; that is, contribute a portion of the cost of the property. This down payment may be expressed as a portion of the value of the property . The loan to value ratio is the size of the loan against the value of the property.

Buying a home with a VA-backed loan

The best way to determine your "separation information" is by obtaining a copy of DD Form 214, Certificate of Release or Discharge from Active Duty. This form will lay out what type of separation occurred and the character of your service. Veterans United financed $4.1 billion in 2013, accounting for 3% of the VA's total loan volume. In 2007, Inc. magazine put the company at No. 96 on its list of the 500 fastest-growing private companies based on its three-year sales growth of 1,553.3 percent and loan volume of $10.2 million. The VA loan application is a standardized loan application form 1003 issued by Fannie Mae also known as Freddie Mac Form 65.

They may also require you to meet additional standards before giving you a loan. These standards may include having a high enough credit score or getting an updated home appraisal (an expert’s estimate of the value of your home). Find out if you can get a VA-backed IRRRL to help reduce your monthly payments or make them more stable. Ask your real estate agent for advice on other options for voiding the contract you may want to include, such as if the property fails a home inspection. If you are currently on active duty or are a reservist or national guard member, you will need a letter signed by your commander or higher headquarters. The letter must contain your name, Social Security Number, date of birth, entry date on duty, the duration of any lost time, and the name of the command providing the information.

Veterans United Home Loans Amphitheater

You can track your credit by studying and building up your credit score. Your credit score is calculated based on your payment history, the amount of money you owe, the length of your credit history, and the types of credit you have. Before a bank will lend you a large sum of money to purchase a house with (i.e., a mortgage), you will need to prove to the bank that you have the financial ability to manage such a loan. Refinancing Loans.50%Manufactured Home Loans1.00%Loan Assumptions.50%Veterans who previously lived in a home they had to then rent out will typically qualify for a no appraisal Interest Rate Reduction Refinance.

The VA loan allows veterans 103.6 percent financing without private mortgage insurance or a 20 percent second mortgage and up to $6,000 for energy efficient improvements. A VA funding fee of 0 to 3.6% of the loan amount is paid to the VA; this fee may also be financed and some may qualify for an exemption. In a purchase, veterans may borrow up to 103.6% of the sales price or reasonable value of the home, whichever is less.

As of 2020, over 25 million VA home loans have been insured by the government. Lenders provide funds against property to earn interest income, and generally borrow these funds themselves . The price at which the lenders borrow money, therefore, affects the cost of borrowing. Lenders may also, in many countries, sell the mortgage loan to other parties who are interested in receiving the stream of cash payments from the borrower, often in the form of a security . Mortgage loans are generally structured as long-term loans, the periodic payments for which are similar to an annuity and calculated according to the time value of money formulae. The most basic arrangement would require a fixed monthly payment over a period of ten to thirty years, depending on local conditions.

These programs include the Government National Mortgage Association , the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation . Interest-only lifetime mortgage schemes are currently offered by two lenders – Stonehaven and more2life. They work by having the options of paying the interest on a monthly basis. By paying off the interest means the balance will remain level for the rest of their life.

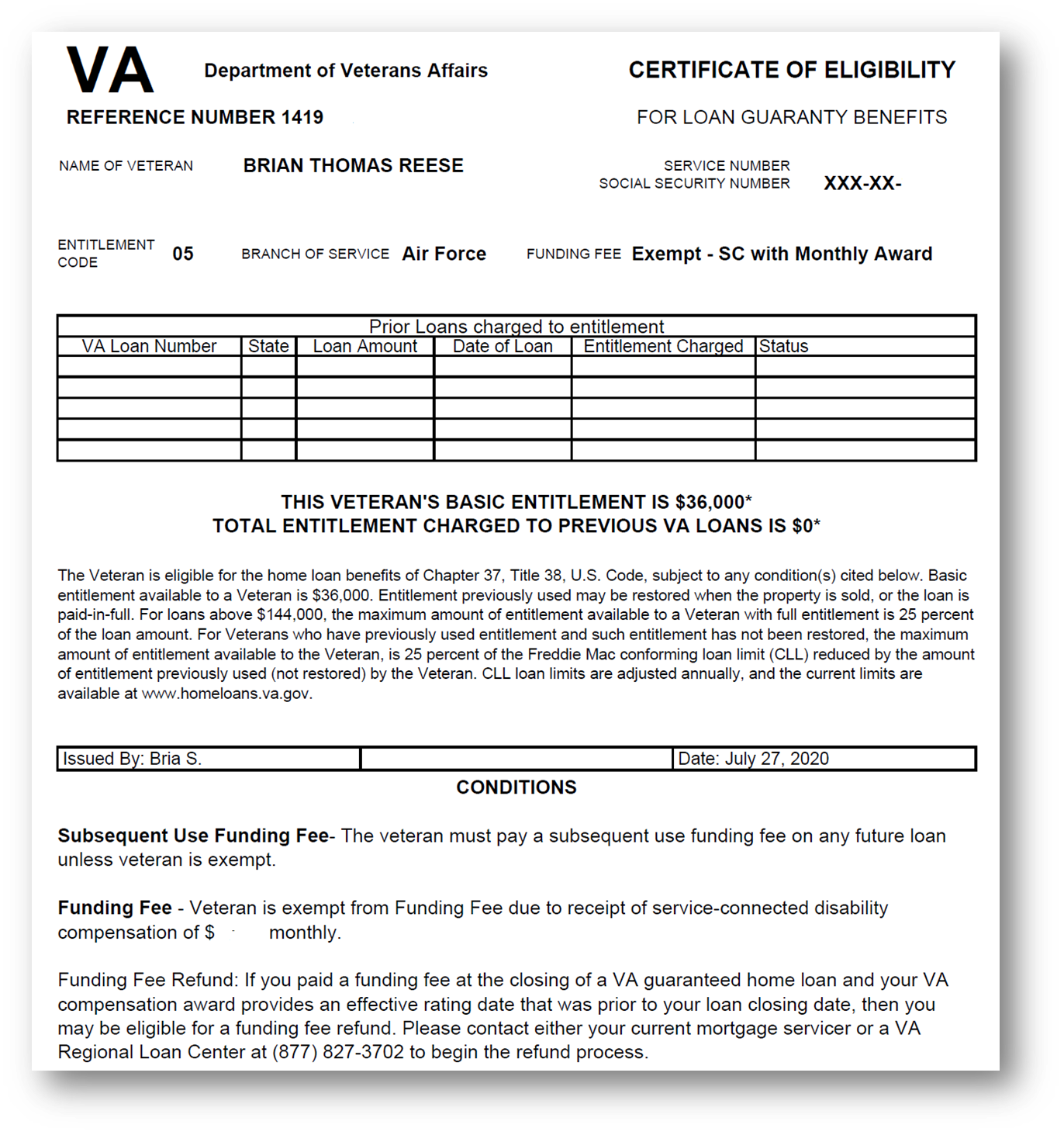

Learn how VA-backed and VA direct home loans work—and find out which loan program might be right for you. On your COE, in the table called Prior Loans charged to entitlement, we list the amount of your entitlement you’ve already used under the Entitlement Charged column. Your entitlement can be restored when you sell your property and pay your VA-backed loan in full, or repay in full any claim we’ve paid. You may need to make a down payment if you’re using remaining entitlement and your loan amount is over $144,000. This is because most lenders require that your entitlement, down payment, or a combination of both covers at least 25% of your total loan amount. With remaining entitlement, your VA home loan limit is based on the county loan limit where you live.

No comments:

Post a Comment